From tax liens to credit card lawsuits, John Hamasaki's personal finances are a mess

Is the district attorney candidate fit to serve as San Francisco's top cop?

Much has been made of former police commissioner and district attorney candidate John Hamasaki’s deletion of nearly 9,000 off-the-rails Twitter posts, but nothing has been said about his personal financial woes, which should definitely be considered when someone is running to be the top cop of a major city. In fact, public records reveal Hamasaki has a long history of not paying his bills. Besides being a harbinger of one’s character, why is this important? Because any person in a position of immense power is susceptible to corruption, and having thousands of dollars in debt puts them at even higher risk.

Take for example the 2017 case against Philadelphia District Attorney Rufus Seth Williams, who admitted accepting tens of thousands of dollars’ worth of concealed bribes in exchange for his agreement to perform official acts and used political action committee funds and official government vehicles for his personal benefit. The indictment alleged that Williams compromised himself and his elected office by using his position to help those willing to secretly pay him with valuable items like money, trips, and cars, as well as defrauding his political action committee and others.

Then there is the case against Orleans Parish District Attorney Jason Williams, who was hit with a federal tax lien in May of this year for failing to pay over $200,000 to the IRS in 2019. Williams is also facing federal charges that he conspired to inflate business expenses $700,000 to lower his tax burden by $200,000 between 2013 and 2017. The government wants to present evidence dating back to 2002 of Williams’ tax problems, including “delinquencies, late filings, correspondence showing his disputes with the IRS, and a large tax lien placed on Williams’ property.”

Of course, anyone familiar with my writing in the Marina Times knows about the many high ranking city officials who have been indicted for taking bribes or otherwise abusing their power for personal and financial gain. It’s a story as old as time, but a particularly potent one here in Gotham by the Bay, which ranks as one of the most corrupt cities in the nation. If you’ve been sued by credit card companies and have unpaid tax liens to the state and the federal government, at the very least a red flag should go up when you run for public office.

THOUSANDS IN CREDIT CARD DEBT

According to public records, as recently as 2017 Hamasaki has faced several different civil lawsuits, including two that resulted in judgments against him totaling nearly $10,000. Hamasaki was named as a defendant in the following four civil lawsuits, which were filed between 1990 and 2017:

• In May 2017, Hamasaki was sued by Portfolio Recovery Associates, LLC for defaulting on $1,219.65 in payments due to Synchrony Bank/Amazon.com. The case was dismissed on May 14, 2018.

• In April 2017, Hamasaki was sued by Capital One Bank for $2,691.99 in damages. In October 2017, the case was settled on conditional terms. Hamasaki agreed to pay the full amount of $2,691.99.

• In July 2000, Hamasaki was sued by First Select, Inc., and in February 2001, Hamasaki was ordered to pay a total of $6,592.38 to the company. On November 19, 2008, an acknowledgment that the judgment was satisfied in full was filed with the San Francisco County Superior Court.

• In May 1990, Hamasaki was listed as a defendant along with his father Duco in a lawsuit filed by State Farm Mutual Auto Insurance. The complaint was for $3,143. Two months later, in July 1990, the case was dismissed.

LIENS AND LAWSUITS

In August 2019, John Hamasaki and his wife Hana Azman were the subjects of a $16,958.29 federal tax lien for unpaid 1040 income taxes for tax years 2016 and 2017. As of today, there was no release on file for the lien with the San Francisco County Recorder’s office.

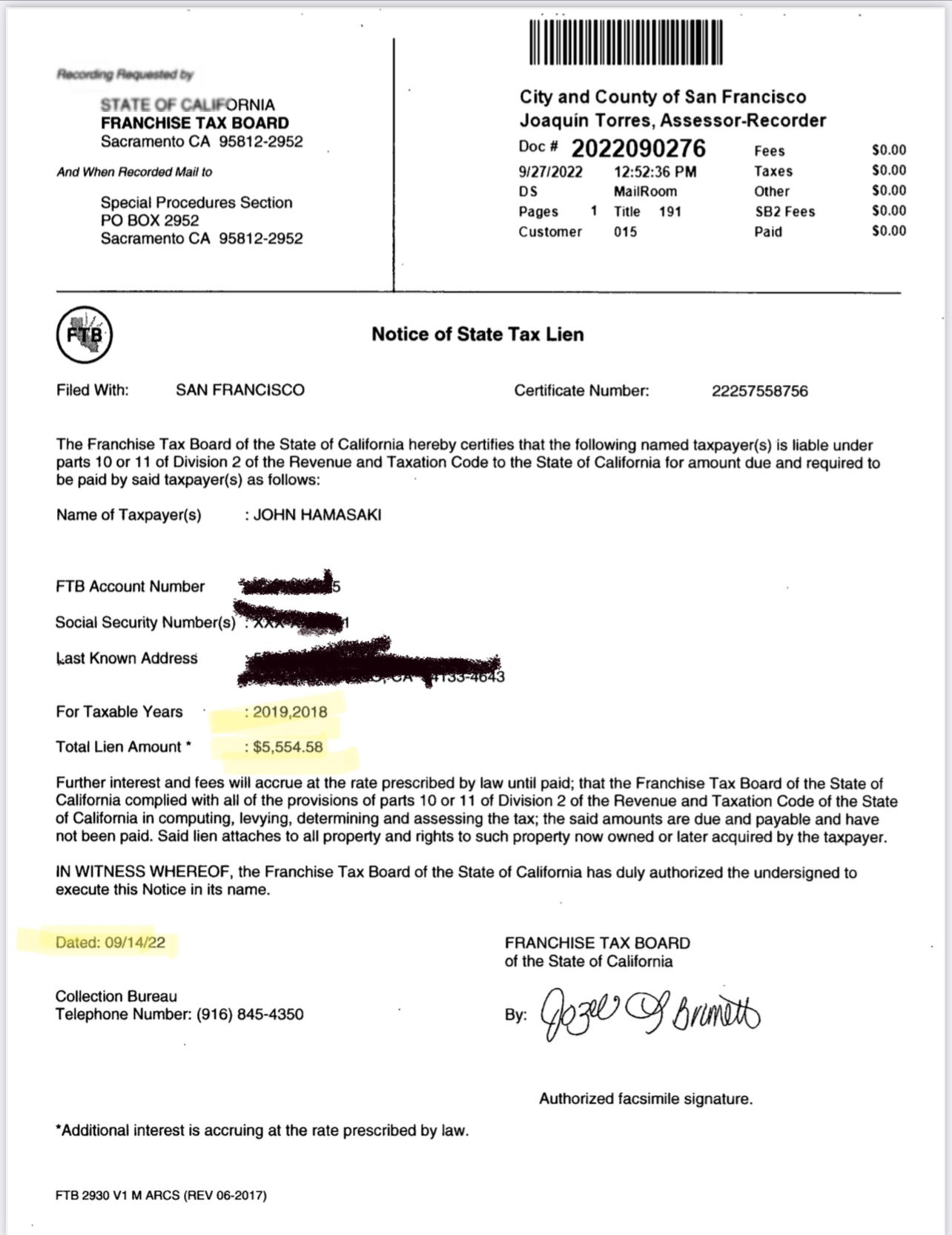

After declaring his candidacy for district attorney on August 11, 2022, you would think Hamasaki would have taken care of that 2019 IRS tax lien. Not only did he not take care of it, but almost exactly one month later, on September 14, 2022, the Franchise Tax Board of the State of California filed a $5,554.58 tax lien against him for unpaid taxes in 2018 and 2019.

In November 2016, Hamasaki Law was named as a defendant in a complaint filed by Jenny J. Kim, a resident and owner of an apartment unit in San Francisco who alleged that defendants in the case attempted to reverse the plaintiff’s grant deed and deed of reconveyance for her residence and prevented her from entering her home. (Complaint, “Jenny J Kim vs. 1856 Franklin Street HOA,” The Superior Court of California County of San Francisco,” filed November 21, 2016.)

The complaint alleged that Hamasaki and other legal counsel involved in the case secretly consulted with the homeowner’s association board and refused to negotiate with Kim in good faith, which resulted in her incurring substantial costs. (Complaint, “Jenny J Kim vs. 1856 Franklin Street HOA,” The Superior Court of California County of San Francisco,” filed November 21, 2016.)

It further alleged that Hamasaki made demands for attorney fees from Kim despite “intentionally faulty legal work,” stating: “On or around August 2016, Hamasaki and Haigh began making demands for attorneys' fees, despite their intentionally faulty legal work resulting in a civil harassment restraining order being awarded against a completely different individual by the name of Ji Hyun Kim. As of this time, they have not served the restraining order or any pleadings after September 1, 2016 to Plaintiff, however, they continue to contact Plaintiff seeking money.” (Complaint, “Jenny J Kim vs. 1856 Franklin Street HOA,” The Superior Court of California County of San Francisco,” filed November 21, 2016.)

In April 2017, the plaintiff attorneys filed a request for dismissal, asking the clerk to dismiss Hamasaki Law as a defendant in the case. (Request for Dismissal, “Jenny J. Kim vs. 1856 Franklin Street HOA,” Superior Court of California, County of San Francisco,” filed April 3, 2017), but the allegations are still troubling.

Also troubling is a July 3, 2002, money claim for $5,000 Hamasaki filed against defendant Lahela Kahulani Chapman (The Superior Court of California County of San Francisco, “Hamasaki, John Midori vs. Chapman, Lahela Kahulani,” filed July 3, 2002). On August 14, 2002, the court ordered a judgement determining that Hamasaki was not owed any money by Chapman and, on that same day, Chapman filed for a domestic violence restraining order against Hamasaki. Since the exhibits in the $5,000 money claim were ordered destroyed there is no further information on the case, but as a candidate for one of the most powerful offices in the City — an office that prosecutes domestic abusers and protects their victims — it seems Hamasaki owes the voters of San Francisco an explanation.

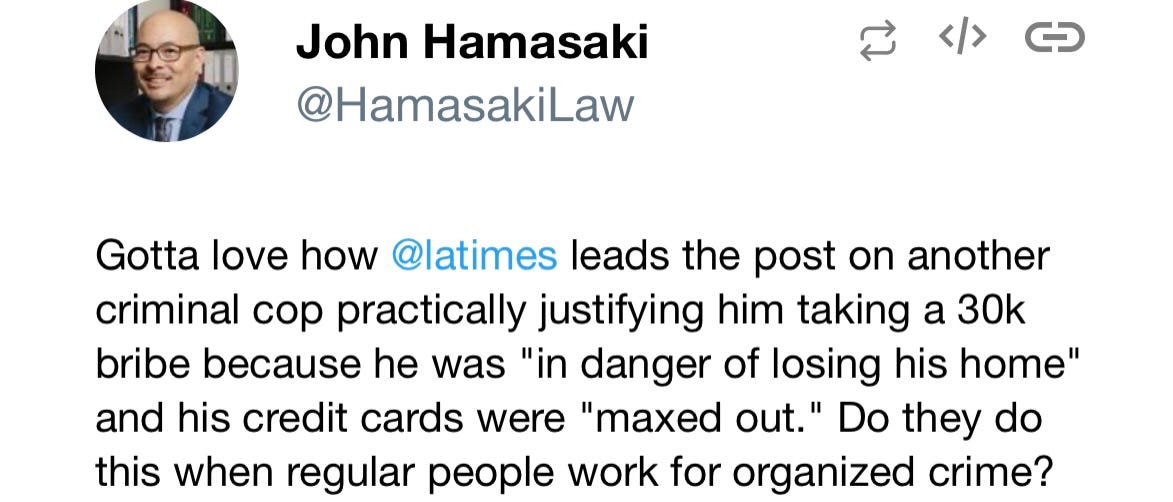

Voters should also carefully consider whether Hamasaki is qualified to create and manage a multimillion dollar budget for the District Attorney’s Office and be the sole decision maker on how to handle every criminal case in the City when he can’t even pay his own bills. As the would-be district attorney says himself in one since-deleted tweet: “Gotta love how @latimes leads the post on another criminal cop practically justifying him taking a 30k bribe because he was in danger of losing his home and his credit cards were maxed out…”